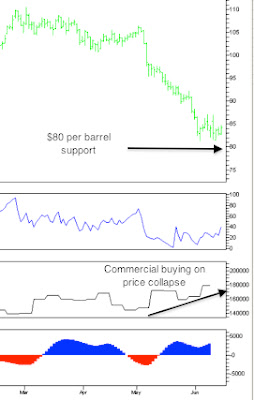

Commitment of Traders Report Points to Higher Silver Prices

Commercial traders building position for silver futures rally.

June 26, 2012

This trade setup is merely a

random sample of the day’s trades generated by COT Signals. To track our work

their and receive all of our nightly trading recommendations, click here.

The commercial traders have nailed

the silver market for the last few months. They were the heaviest sellers at

the March highs. They sold more than 10,000 contracts through the month of

February.

They’ve also been the heaviest

buyers through the May – June decline, adding 7,000 contracts in the last

month. These additions have pushed their position just above their buying

levels in early January.

Their buying has also led to a

technical divergence in the ARSI momentum indicator. We can see that the market

made a new low on Friday’s trade, down to $26.57. However, the ARSI’s significantly

higher reading in light of the market’s new lows provides evidence of a

turnaround in the market, rather than continued downside.

We will be buying September silver

futures and placing a protective sell stop at the swing low of $26.57.

If you would like to trade commodities with us, please go to Commodity & Derivative Advisors.

If you would like to trade commodities with us, please go to Commodity & Derivative Advisors.

ANDREW WALDOCK

866-990-0777

This

information is not to be construed as an offer to sell or a solicitation or an

offer to buy the commodities herein named. The factual information of this

report has been obtained from sources believed to be reliable, but is not

necessarily all-inclusive and is not guaranteed as to the accuracy, and is not

to be construed as representation by Commodity & Derivative Adv. The risk

of trading futures and options can be substantial. Each investor must consider

whether this is a suitable investment. Past performance is not indicative of

future results.